|

Why the Liberal/National Coalition are NOT good money managers.

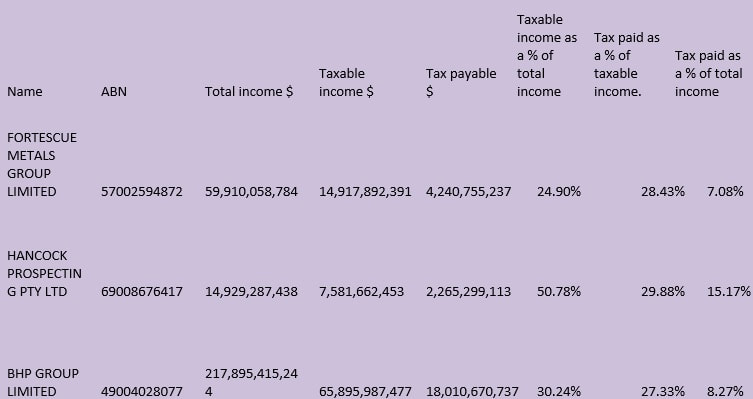

Fact 1. Recently Josh Freydenburg, the federal Treasurer of Australia has been saying that the federal ALP had a tax plan before the 2019 election to Tax Australians “We know that from their previous record, and we know that from the $387 billion of high taxes they took to the Australian people.” Source Hansard page 44/133 dated Tuesday 30th November 2021. The Australian Labor party had no such policy. Fact 2. In 2013 when they came to Power the Liberal/National coalition had the Taxation of entities who had income of over $100 million per Annum published by the Australian Taxation office. It should be noted that the ATO is a department of treasury. Fact 3. The first Treasurer in the Abbott government from 2013 to 2015 was Joe Hockey The Second treasurer under the Turnbull Government was Scott Morrison from 2015 to 2018. The third treasurer under the Morrison government was and is Joshua Frydenberg. Fact 4. In the Six data releases (2013-14 to 2018-19) of those entities who earned income of more than $100 million per Annum a total of $11,379,089,835,136 was earned. This amount is Eleven trillion, three hundred and seventy nine billion, eighty nine million and one hundred and thirty six thousand dollars. See Section 2 of the attached spreadsheet. Fact 4.1 Of that $11.3 trillion, $1,159,744,513,545 of it ($1.1 trillion) was taxable income. This represents 10.16% of total Income. See Section 2 of the attached spreadsheet. Fact 4.2 The Tax paid on that $1.1 trillion was $276,269,618,430 ($276.2 billion) which represented an actual tax rate paid of 23.82% (the company tax rate is 30%). See Section 2 of the attached spreadsheet. Fact 4.3 The proportion of the Entities who paid Tax over the six years was 72.17%. They earned a total of $9,377,271,255,264 ($9.3 trillion). See Section 3 of the attached spreadsheet. Fact 4.4. The proportion of Entities who paid no tax over the six years was 27.83% They earned a total of $2,001,818,579,872 ($2.0 trillion). See Section 4 of the attached spreadsheet. Fact 4.5. The amount of Tax paid as a Proportion of Total Income ($11.3 trillion) was 2.3%. And as stated in Fact 4.2 was 23.82% of Taxable income. ($1.1 trillion). Conclusion. Taxes collected depend on what proportion of total income is taxable and whether that taxable income is taxed at 30% (The company Tax rate). Some more facts. Fact 5. The following three iconic Australian companies paid their tax rates over the six years as follows. |

Two of these companies are close supporters of the Liberal National Coalition Government. And BHP group is Australia’s best known company.

All three have a greater proportion of taxable income as a %age of total Income than the majority of the entities in the data. They exhibit that trait over the 6 years of data.

They also pay more tax as a proportion of their Taxable income than the Majority of entities in the data.

In other words these three iconic companies pay their taxes as they are supposed to.

See Section one of the attached spreadsheet.

What if?

So what if all the entities in the data had been made to have 20% of their Total Income as taxable income and paid 30% tax on that taxable income.

Bear in mind that

Fortescue Metals had 24.9% of it’s Total income as taxable over the six year period.

Hancock prospecting had 50.78% of it’s Total income as taxable over the six year period.

BHP Group Limited had 30.24% of it’s Total income as taxable over the six year period.

So asking companies to submit 20% of their total income as taxable income is not at all outrageous as an assumption. In effect it’s asking the total Entity group to add another 10% of their total income to be taxable at 30%.

The result over the six years would have been another $406,475,771,678 ($406.4 billion) into consolidated revenue.

Fact 6.

Despite claiming there would be a budget Surplus in all the years of a Coalition government, Joe Hockey couldn’t have been more wrong.

In the 6 years of the Tax collected data the coalition governments have had an aggregate deficit of -$174,500,000,000 (minus $174.5 billion).

If we apply the 20% of Taxable income @ 30% tax paid in the What if scenario above the Surplus of the 6 years of data provided by the Tax department would be $231,975,771,678. (231.9 billion an average of $38 billion a year.)

Final Conclusions.

1/ The Liberal/National Coalition Treasurers, Joe Hockey, Scott Morrison and Josh Frydenberg have had no idea of the tax minimisation that larger business entities have been practicing for 6 years under the coalition.

2/ Joe Hockey wouldn’t have needed to have said, “the age of entitlement is over” because there would have been plenty of money in the kitty to fund the NDIS. Disability Support Pensions, a raise in Newstart/Jobseeker payments above the poverty levels they are presently at.

3/ Scott Morrison as Social Security Minister wouldn’t have needed to take $2.3 billion out of the aged pension system and to place 400,000 pensioners under the poverty line.

4/ The Government wouldn’t have needed to illegally claw back the fictitious Robodebt debts. A saving they claimed of $2 billion but which when found out actually cost more than $1 billion to pay back the illegal clawback. Many people committed suicide as a result of the stress that visited on them.

5/ If the Liberal/National Coalition knew what they were doing and what taxation revenue was on offer by actually enforcing the existing tax laws they could have subsidised the Australian motor vehicle manufacturing Industry, instead of closing it down under Hockey. Saving 200,000 skilled jobs and skills in advanced manufacturing.

6/ If they actually understood what was happening with the taxation which was being minimised under their watch, they could have fully funded the Gonski Education proposals and Australia would indeed have become a much cleverer country.

7/ If they actually understood what was happening with the taxation which was being minimised under their watch they could have reduced the cost of university places and funded those powerhouses of research to make Australia a better place.

8/ Finally and tellingly this Coalition government could have invested in climate science technology instead of denying that climate change existed.

The Coalition claim that they are better money managers than Labor.

They are demonstrably wrong.

Frydenberg lies about Labor Tax policy and introducing new taxes which just don’t exist.

Labor don’t need to raise taxes. The laws and tax rates to collect the necessary revenue are there already. The coalition has wilfully refused to even understand what they should be in receipt of.

All Labor need to do when they get on the treasury benches is to collect the taxes which have already been legislated.

And a Final word.

I bet Gina and Twiggy are pissed off with these three genius Treasurers who couldn’t even organise a drunk in a distillery (if they had the keys), because they pay their taxes and their mates in government allow others to get away with wholesale tax minimisation.

All three have a greater proportion of taxable income as a %age of total Income than the majority of the entities in the data. They exhibit that trait over the 6 years of data.

They also pay more tax as a proportion of their Taxable income than the Majority of entities in the data.

In other words these three iconic companies pay their taxes as they are supposed to.

See Section one of the attached spreadsheet.

What if?

So what if all the entities in the data had been made to have 20% of their Total Income as taxable income and paid 30% tax on that taxable income.

Bear in mind that

Fortescue Metals had 24.9% of it’s Total income as taxable over the six year period.

Hancock prospecting had 50.78% of it’s Total income as taxable over the six year period.

BHP Group Limited had 30.24% of it’s Total income as taxable over the six year period.

So asking companies to submit 20% of their total income as taxable income is not at all outrageous as an assumption. In effect it’s asking the total Entity group to add another 10% of their total income to be taxable at 30%.

The result over the six years would have been another $406,475,771,678 ($406.4 billion) into consolidated revenue.

Fact 6.

Despite claiming there would be a budget Surplus in all the years of a Coalition government, Joe Hockey couldn’t have been more wrong.

In the 6 years of the Tax collected data the coalition governments have had an aggregate deficit of -$174,500,000,000 (minus $174.5 billion).

If we apply the 20% of Taxable income @ 30% tax paid in the What if scenario above the Surplus of the 6 years of data provided by the Tax department would be $231,975,771,678. (231.9 billion an average of $38 billion a year.)

Final Conclusions.

1/ The Liberal/National Coalition Treasurers, Joe Hockey, Scott Morrison and Josh Frydenberg have had no idea of the tax minimisation that larger business entities have been practicing for 6 years under the coalition.

2/ Joe Hockey wouldn’t have needed to have said, “the age of entitlement is over” because there would have been plenty of money in the kitty to fund the NDIS. Disability Support Pensions, a raise in Newstart/Jobseeker payments above the poverty levels they are presently at.

3/ Scott Morrison as Social Security Minister wouldn’t have needed to take $2.3 billion out of the aged pension system and to place 400,000 pensioners under the poverty line.

4/ The Government wouldn’t have needed to illegally claw back the fictitious Robodebt debts. A saving they claimed of $2 billion but which when found out actually cost more than $1 billion to pay back the illegal clawback. Many people committed suicide as a result of the stress that visited on them.

5/ If the Liberal/National Coalition knew what they were doing and what taxation revenue was on offer by actually enforcing the existing tax laws they could have subsidised the Australian motor vehicle manufacturing Industry, instead of closing it down under Hockey. Saving 200,000 skilled jobs and skills in advanced manufacturing.

6/ If they actually understood what was happening with the taxation which was being minimised under their watch, they could have fully funded the Gonski Education proposals and Australia would indeed have become a much cleverer country.

7/ If they actually understood what was happening with the taxation which was being minimised under their watch they could have reduced the cost of university places and funded those powerhouses of research to make Australia a better place.

8/ Finally and tellingly this Coalition government could have invested in climate science technology instead of denying that climate change existed.

The Coalition claim that they are better money managers than Labor.

They are demonstrably wrong.

Frydenberg lies about Labor Tax policy and introducing new taxes which just don’t exist.

Labor don’t need to raise taxes. The laws and tax rates to collect the necessary revenue are there already. The coalition has wilfully refused to even understand what they should be in receipt of.

All Labor need to do when they get on the treasury benches is to collect the taxes which have already been legislated.

And a Final word.

I bet Gina and Twiggy are pissed off with these three genius Treasurers who couldn’t even organise a drunk in a distillery (if they had the keys), because they pay their taxes and their mates in government allow others to get away with wholesale tax minimisation.